Sri Lanka Tea Production for the month of January 2025 totalled 21.46 million Kgs, recording an increase of 2.93 million Kgs vis-à-vis 18.53 million Kgs of January 2024. All Elevations have recorded an increase in comparison with the corresponding month of 2024.

Compared to 18.47 million Kgs of January 2023, the corresponding month shows an increase of 2.99 million Kgs.

The available tea crop figures for the month of January 2025 are appended below (in MT).

CATEGORY |

QUANTITY (MT) |

Orthodox |

19,430 |

CTC |

1,840 |

Green |

191 |

Total |

21,463 |

( SLTB )

Tea Exports for the month of January 2025 totalled 19.37 million Kgs, showing an increase of 0.61 million Kgs vis-à-vis 18.76 million Kgs of January 2024. Tea Packets, Tea Bags and Instant Tea categories have recorded gains, whilst Tea in Bulk and Green Tea categories record a decline.

FOB value in January 2025 was recorded at Rs. 1,722.78, a decline of Rs. 26.14 YoY compared to Rs. 1,748.92 of January 2024. In USD terms, however, the month of January witnessed an increase of USD 0.38 in comparison with the corresponding period in the year 2024

Iraq ranks at No. 1 amongst major importers of Ceylon Tea with a total of 3.02 million Kgs, an increase of 21% YoY in comparison with January 2024 of 2.50 million Kgs, whilst Russia at 2nd place has witnessed a marginal decline of 11% YoY with 1.77 million Kgs vis-à-vis 1.98 million Kgs recorded in 2024. Libya has moved up to 3rd Place with 1.68 million Kgs (406% increase YoY) followed by the U.A.E with 1.27 million Kgs (36% decrease YoY), Türkiye 1.08 million Kgs (37% decrease YoY), Chile 0.78 million Kgs (24% increase YoY). Saudi Arabia has secured 7th place with 0.89 million Kgs edging over China's 0.80 million Kgs (5% increase YoY) who have been cited as other notable importers of Ceylon Tea for the month of January 2025.

The tea export figures for the month of January 2025 are listed below (in MT).

DESCRIPTION |

QUANTITY (MT) |

Bulk |

8,241 |

Tea in Packets |

8,492 |

Tea In Bags |

2,106 |

Instant Tea |

199 |

Green Tea |

334 |

TOTAL |

19,374 |

COUNTRY |

2025 | 2024 |

IRAQ |

3,027 | 2,505 |

RUSSIA |

1,773 | 1,981 |

LIBYA |

1,682 | 332 |

| U.A.E. | 1,278 | 1,998 |

TURKIYE |

1,082 | 1,722 |

CHILE |

975 | 785 |

SAUDI ARABIA |

897 | 762 |

CHINA |

802 | 766 |

IRAN |

798 | 1,328 |

SYRIA |

663 | 518 |

(Source – Forbes & Walker Tea Brokers (Pvt) Ltd)

Sri Lanka Tea Production for the month of December 2024 totalled 21.71 million Kgs, recording an increase of 1.91 million Kgs vis-à-vis 19.80 million Kgs of December 2023. All Elevations have recorded an increase in comparison with the corresponding month of 2023.

Compared to 19.70 million Kgs of December 2022, the corresponding month of 2024 shows an increase of 2.01 million Kgs.

January-December 2024 cumulative production totalled 262.16 million Kgs, recording an increase of 6.07 million Kgs vis-à-vis 256.09 million Kgs of January-December 2023. Compared to the corresponding period in 2023, High Growns have shown a negative variance, whilst Medium and Low Growns gained in the year 2024.

Compared to 251.84 million Kgs of January-December 2022, cumulative production of 2024 shows an increase of 10.32 million Kgs. On a cumulative basis, apart from the High Growns, all elevations have shown positive variances over the corresponding period of 2022.

The available tea crop figures for the period from January to December 2024 are appended below (in MT).

CATEGORY |

QUANTITY (MT) |

Orthodox |

236,216 |

CTC |

23,680 |

Green |

2,261 |

Total |

262,159 |

( SLTB )

Tea Exports for the month of December 2024 totalled 22.56 million Kgs, showing an increase of 1.81 million Kgs vis-à-vis 20.75 million Kgs of December 2023. All other categories have recorded gains, except for the Instant Tea category. FOB value in December 2024 was recorded at Rs. 1,701.05, a decline of Rs. 48.35 YoY compared to Rs. 1,749.40 of December 2023. In USD terms however, the month of December witnessed an increase of 0.48 in comparison with the corresponding period in the year 2023.

January-December 2024 cumulative exports totalled 245.78 million Kgs, recording an increase of 3.87 million Kgs vis-à-vis 241.91 million Kgs of January-December 2023. Tea Packets and Instant Tea segments have recorded negative variances, whilst all other categories have shown positive variances against the same period of the previous year.

FOB value for the period stood at Rs. 1,763.61, a decrease of Rs. 6.83 (increase of USD 0.45) vis-à-vis Rs. 1,770.44 of January-December 2023.

All other categories except for Tea in Bulk showed negative variances in LKR terms in FOB value, whilst gains were recorded in USD terms in all other categories when compared to the corresponding period in 2023.

Iraq ranks at No. 01 amongst major importers of Ceylon Tea with a total of 34.26 million Kgs, an increase of 5% YoY in January-December 2024 against the previous year's 32.75 million Kgs, whilst Russia at 2nd place has witnessed an increase of 10% YoY with 24.98 million Kgs vis-à-vis 22.61 million Kgs recorded in 2023. The U.A.E with 21.13 million Kgs (14% increase YoY) followed by Türkiye 17.37 million Kgs (42% decrease YoY) and China 11.56 million Kgs (6% decrease YoY). Azerbaijan has secured 6th placed with 10.43 million Kgs edging over Iran's 10.43 million Kgs (60% increase YoY) who have been cited as other notable importers of Ceylon Tea in the period of January-December 2024.

The tea export figures for the period from January to December 2024 are listed below (in MT).

DESCRIPTION |

QUANTITY (MT) |

Bulk |

111,074 |

Tea in Packets |

101,818 |

Tea In Bags |

25,584 |

Instant Tea |

2,623 |

Green Tea |

4,687 |

TOTAL |

245,787 |

COUNTRY |

2024 | 2023 |

IRAQ |

34,260 | 32,751 |

RUSSIA |

24,987 | 22,617 |

U.A.E. |

21,132 | 18,460 |

| TURKEY | 17,734 | 30,411 |

CHINA |

11,564 | 12,319 |

AZERBAIJAN |

10,435 | 9,176 |

IRAN |

10,432 | 6,501 |

LIBYA |

10,291 | 11,127 |

SAUDI ARABIA |

9,138 | 7,012 |

CHILE |

8,638 | 7,887 |

(Source – Forbes & Walker Tea Brokers (Pvt) Ltd)

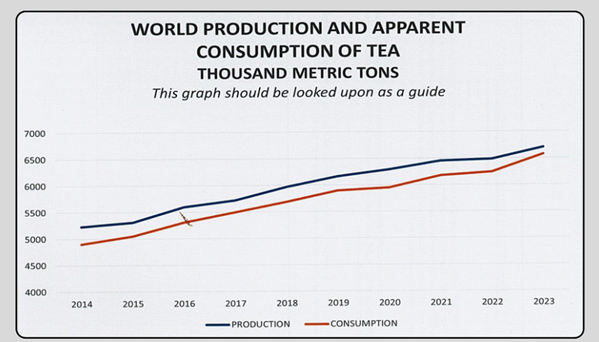

From a Sri Lankan perspective, consequent to the decline in tea crop over the last several years and the 2024 deficit in Indian tea production, there is possibly a shortfall created or tight supply situation of Orthodox Large Leaf teas.

In addition, the 1st quarter being a lean cropping period in most producer countries, combined with Sri Lanka experiencing its Western quality season, we could predict tea prices to remain buoyant during Q1 and perhaps even in the first half of Q2. Thereafter, much would depend on the supply dynamics of world tea production.

Needless to say, the parity of the SLR vs. USD, particularly as the country intends to gradually relax the restrictions on import of vehicles etc., will also impact rupee tea prices.

However, factors such as climate change, input costs, mechanization & wages, Government policies and use of fertilizer etc., affecting tea production in Sri Lanka would enable us to project with cautious optimism an annual 280 M/Kgs for the year 2025.

In summary, the tea market in 2025 is expected to see modest growth in production, with significant opportunities in key markets like India and China. However, economic challenges and weather uncertainties could impact overall market dynamics. The focus on quality and sustainability will be crucial for maintaining competitiveness in the global market.

(Forbes & Walker Tea Brokers (Pvt) Ltd)