Sri Lanka Tea Production for the month of February 2024 totalled 19.99 million Kgs, showing an increase of 1.24 million Kgs vis-à-vis 18.75 million Kgs of February 2023. All elevations show an increase, whilst only Green Tea shows a marginal decrease in comparison with the corresponding month of 2023.

January-February 2024 cumulative production totalled 38.53 million Kgs, recording an increase of 1.30 million Kgs vis-à-vis 37.23 million Kgs of January-February 2023. Compared to the corresponding period in 2023, once again all the elevations have shown positive variances in the year 2024, other than Green Tea which has shown a marginal negative variance.

Compared to 41.09 million Kgs of January-February 2022, cumulative production of 2024 shows a decrease of 2.56 million Kgs. On a cumulative basis, all elevations show a decrease over the corresponding period of 2022 including Green Tea.

The available tea crop figures for the first two months are appended below (in MT).

CATEGORY |

QUANTITY (MT) |

Orthodox |

34,639 |

CTC |

3,558 |

Green |

333 |

Total |

38,532 |

( SLTB )

Tea Exports for the month of February 2024 totalled 22.31 million Kgs, showing a positive variance of 3.76 million Kgs vis-à-vis 18.55 million Kgs of February 2023. All categories except for Tea Packets and Green Tea have shown improvements in comparison with the corresponding month of the previous year.

January-February 2024 cumulative exports totalled 41.08 million Kgs, showing an increase of 4.97 million Kgs vis-à-vis 36.11 million Kgs of January-February 2023. All categories except for Tea Packets continue to show steady growth against the same period of the previous year.

F.O.B value for the period stood at Rs. 1,770.92, a decrease of Rs. 276.67 vis-à-vis Rs. 2,047.59 of January-February 2023.

All categories showed negative variances in SLR terms and a marginal increase in USD terms except for Green Tea when compared to the corresponding period of 2023.

Iraq has been ranked at No. 01 amongst major importers of Ceylon Tea with a total of 5.30 million Kgs, an increase of 14% YoY in January-February 2024 against the previous year's 4.66 million Kgs. UAE (4.98 million Kgs) and Russia (4.52 million Kgs) emerged at 2nd and 3rd positions respectively, surpassing Türkiye who recorded a decline of 38% against the corresponding period of the previous year. Other notable importers countries are Iran, Saudi Arabia, China, Germany, Azerbaijan and Chile.

The tea export figures for the first two months are listed below (in MT).

DESCRIPTION |

QUANTITY (MT) |

Bulk |

19,608 |

Tea in Packets |

16,135 |

Tea In Bags |

4,132 |

Instant Tea |

446 |

Green Tea |

754 |

TOTAL |

41,076 |

COUNTRY |

2024 |

2023 |

IRAQ |

5,303 |

4,663 |

U.A.E. |

4,980 |

3,450 |

RUSSIA |

4,526 |

3,686 |

| TURKEY | 2,984 | 4,785 |

IRAN |

2,903 |

919 |

SAUDI ARABIA |

1,629 |

1,242 |

CHINA |

1,596 |

1,405 |

GERMENY |

1,570 |

710 |

AZERBAIJAIN |

1,494 |

1,544 |

CHILE |

1,468 |

8242 |

(Source – Forbes and Walker Tea Brokers)

Sri Lanka Tea Production for the month of December 2023 totalled 19.81 million Kgs, showing an increase of 0.10 million Kgs vis-à-vis 19.71 million Kgs of December 2022. All Elevations except for the Low Grown Elevation have shown an increase in comparison with the corresponding period of 2022.

Compared to 20.52 million Kgs of December 2021, the production of December 2023 shows a decrease of 0.71 million Kgs.

January-December 2023 cumulative production totalled 256.04 million Kgs, recording an increase of 4.20 million Kgs vis-à-vis 251.84 million Kgs of January-December 2022. Compared to the corresponding period in 2022, all elevations have shown positive variances in the year 2023 aside from the Low Grown Elevation.

Compared to 299.49 million Kgs of January-December 2021, cumulative production of 2023 shows a decrease of 43.45 million Kgs. On a cumulative basis, all elevations show a decrease over the corresponding period of 2021.

The available tea crop figures for the twelve months’ period are appended below (in MT).

CATEGORY |

QUANTITY (MT) |

Orthodox |

231,138 |

CTC |

22,617 |

Green |

2,283 |

Total |

256,039 |

( SLTB )

Tea Exports for the month of December 2023 totalled 20.75 million Kgs, showing an increase of 1.45 million Kgs vis-à-vis 19.30 million Kgs of December 2022. Packeted Tea together with Tea Bags and Green Tea have seen an improvement against the corresponding month of 2022, whilst Tea in Bulk and Instant Tea have shown a decline.

January-December 2023 cumulative exports totalled 241.91 million Kgs, showing a decrease of 8.28 million Kgs vis-à-vis 250.19 million Kgs of January - December 2022. Tea Bags and Green Tea categories have recorded a marginal growth, whilst the remaining product categories recorded a decrease against the same period of 2022.

FOB value for the period stood at Rs. 1,770.44, an increase of Rs. 127.33 vis-à-vis Rs. 1,643.11 of January-December 2022.

All categories showed gains in USD terms as well when compared to the corresponding period of 2022.

Iraq remains at No. 1 amongst major importers of Ceylon Tea with a total of 32.75 million Kgs, a decline of 24% YoY against 43.24 million Kgs in 2022. Türkiye has emerged in 2nd place with 30.41 million Kgs and growing by 95% YoY surpassing Russia (3rd Position) and the U.A.E (4th Position) where exports have declined by 8% and 18% YoY respectively. China has moved up to No. 5 with an increase of 10% against the same period in 2022. Other notable importer countries are Libya, Azerbaijan, Chile, Syria and Saudi Arabia. Iran has dropped from 5th to 11th position with a 50% decline in imports for the period under review.

The tea export figures for the twelve months are listed below (in MT).

DESCRIPTION |

QUANTITY (MT) |

Bulk |

103,328 |

Tea in Packets |

103,328 |

Tea In Bags |

23,230 |

Instant Tea |

2,801 |

Green Tea |

4,516 |

TOTAL |

241,912 |

COUNTRY |

Total 2023 |

Total 2022 |

IRAQ |

32,751,246.20 |

43,245,923.90 |

TÜRKİYE |

30,411,858.41 |

15,595,067.65 |

RUSSIA |

22,617,598.51 |

24,733,188.06 |

| U.A.E | 18,460,239.44 | 22,578,453.69 |

CHINA |

12,319,523.53 |

11,128,882.22 |

LIBYA |

11,127,949.46 |

11,200,518.84 |

AZERBAIJAN |

9,176,628.51 |

12,091,887.13 |

CHILE |

7,887,268.10 |

6,513,522.00 |

SYRIA |

7,083,646.66 |

6,153,517.59 |

SAUDI ARABIA |

7,012,586.93 |

6,270,569.36 |

(Source – Forbes and Walker Tea Brokers)

Supply

Analysts predict global output to increase by 1.5% to 3% in 2024 and 2025, which is far below a historic average of an annual 4.4%, but forecasts are subject to a high degree of uncertainty due to a probable El Niño and the unknown factor of its intensity. From a Sri Lankan perspective, a strict enforcement of the B60 programme compelling tea growers/manufacturers towards an improved standard of green leaf is likely to at least in the short-term restrict availability, whilst perhaps improving the overall availability of quality ‘Ceylon Tea.’ Combining these factors, from a supply point of view, due consideration needs to be given to the fact that the 1st quarter is a lean period for almost all producer countries and in Sri Lanka, the Western quality season experienced during this time of the year lends towards improved availability of better-quality teas.

Yet another factor for consideration is the rising input costs that in inflation adjusted terms would lower farmer profits. As such, prospects for investments in the sector to increase productivity and yields would thus remain weak.

Although global fertilizer prices have eased sharply in 2023, it still remains high by historical comparison. As an alternative, governments in tea producing countries should and are likely to endeavour to offset high input costs by pursuing production efficiencies via technology and the constant labour shortages by improving mechanisation etc. All these factors in the long-term are likely to accelerate production growth, but the boost to output would be mild as the roll-out would be gradual.

Prices

In projecting tea prices, the following would be salient factors for consideration.

➢ Tea consumption in India, which accounts for approximately 20% of global demand, is estimated to rise by 3%-4% in the next 2-3 years. A market with great potential by its sheer size and for Sri Lanka, it is perhaps an opportunity considering its close proximity and trade relations.

➢ Russia, the world’s largest tea importer with an estimated 2% of global tea imports, is likely to be affected by the struggling domestic economy reflecting the impact of sanctions. Consequently, it is most likely to witness a general decline in tea consumption as well during the period under review.

➢ Türkiye, which is yet another important market for Ceylon Tea and accounts for approximately 4% of global consumption, has practically a saturated market, although maintaining the highest consumption per head. Here again, Türkiye’s weak economic performance is likely to hamper teas consumption, resulting in stagnation in imports during the period under review.

➢ Iran, again an important market for Ceylon Tea, is also constrained with trading conditions which is reliant on 3rd party payments often hampering the smooth import and payment for tea.

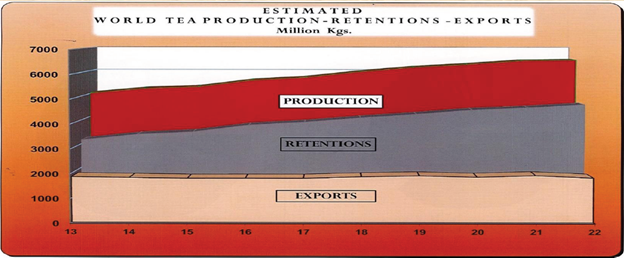

➢ The main tea consuming countries are also the largest producers and in recent years, a rising share of output has been retained for domestic consumption (from a 63% in 2013 to a 72% in 2022).

Source: International Tea Committee

➢ Chinese consumption is likely to grow showing a preference for black tea. Although ready to drink products were rising firmly before the pandemic, analysts predict that quality loose tea will continue to dominate the market.

➢ The US market for tea though small is expected to show a fairly firm growth in consumption. However, with most of the larger tea markets dominated by loose-leaf teas; the US remains one of the most important single markets for instant and iced tea, and perhaps handcrafted specialty teas.

➢ Commitment to sustainability with integrity will afford opportunities and challenges to outperform competitors in the beverage sector.

In Sri Lanka more stringent taxation policies are due to be introduced in 2024, further increasing costs in the manufacturing sector predominantly.

On a more positive note, the IMF bail-out deal expected to be finalised in 2024 would provide an element of confidence for exporters to make more competitive offers in the short to medium term following a more stable parity rate for the Sri Lankan Rupee.

Needless to say, auction prices would also be quite pivotal on the parity rate and if any unforeseen devaluation of the Sri Lankan Rupee would occur during the period under review, it would be beneficial for the industry considering that many importer country currencies too have devalued over a period of time.

The most recent development would be the Red Sea shipping workarounds which is likely to incur costs and delays for suppliers/retailers.

Considering the challenges both locally and globally, predicting tea prices for a longer period of time is a near impossibility. Prices for Q1, particularly in the backdrop of restricted volumes and a general improvement in product quality, are likely to remain buoyant and prices thereafter would largely depend on how economic and trading conditions unfold in other tea producer/importer countries during the period under review.

(Forbes & Walker Tea Brokers (Pvt) Ltd)